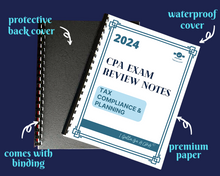

2024 CPA Exam Review Notes | TAX COMPLIANCE AND PLANNING | 33 pages | PRINTED & SHIPPED | 2024 Edition

What's included:

- Summary of key knowledge points

- Examples that illustrate accounting concepts

- Table of contents

Contents include:

- AMT

- Imputed Interest

- Compensation Earned Outside U.S.

- Kiddie Tax

- HSA vs FSA

- Itemized Deduction vs Standard Deduction

- Noncash Property Charitable Contribution

- Taxpayer Penalties

- At-Risk Limit Rule

- Passive Activity Loss Limitation

- Taxable Gifts

- Traditional IRA vs Roth IRA

- 401(K) vs IRA

- Section 351

- Non-Liquidating Distributions

- Corporate Complete Liquidation

- Consolidated Tax Return

- International Taxes

- S Corporations

- Partnership Taxation

- Section 1231 Assets

- Section 1245 Depreciation Recapture

- Section 1250 Depreciation Recapture

- etc.

________________________

You GOT this Future CPA! The world is your oyster!

________________________

*The file is for PERSONAL USE ONLY. Sharing, distributing or reselling without the store owner's consent is forbidden.

**These CPA exam review notes are applicable to the US CPA exam only.