CPA Exam Review Notes | 6 SECTIONS COMPLETE BUNDLE | 213 pages | DIGITAL DOWNLOAD | 2024 Edition

What's included:

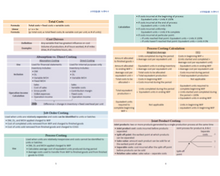

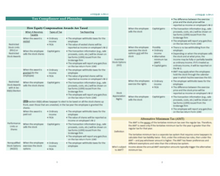

- Summary of key knowledge points

- Examples that illustrate accounting concepts

- Auditing and Attestation (AUD) - 37 pages

- Financial Accounting and Reporting (FAR) - 39 pages

- Taxation and Regulation (REG) - 37 pages

- Business Analysis and Reporting (BAR) - 35 pages

- Information Systems and Controls (ISC) - 32 pages

- Tax Compliance and Planning (TCP) - 33 pages

- Table of contents for each part

Contents include:

- SEC Reporting

- Consolidated Financial Statements

- Intercompany Transactions

- Equity Method

- Non-monetary Transactions

- Depreciation Method

- Foreign Currency Translation

- Contracts

- Partnerships

- C corporations

- S corporations

- Individual Taxation

- Health Saving Accounts (HSA)

- Section 179 Expense Election

- Corporate Taxation

- Partnership Taxation

- Auditors' and Clients' Responsibilities

- Engagement Types for Public and Non-Public Companies

- Independence

- SOC 1 & SOC 2 Reports

- SWOT Analysis

- Supply, Demand & Market Equilibrium

- Share-Based Payments

- Research & Development Costs

- Business Combination

- Leases

- HIPPA

- GDPR

- PCI DSS

- NIST CSF

- The Center for Internet Security (CIS)

- AMT

- Imputed Interest

- Kiddie Tax

- HSA vs FSA

- Noncash Property Charitable Contribution

- etc.

________________________

You GOT this Future CPA! The world is your oyster!

________________________

These are PDF digital downloads. No physical items will be shipped.

*The file is for PERSONAL USE ONLY. Sharing, distributing or reselling without the store owner's consent is forbidden.

**These CPA exam review notes are applicable to the US CPA exam only.